I’ve been blogging a bit about how to build a startup marketing plan, including some thoughts about an overall approach to marketing planning and execution, modelling the customer buying process and creating value propositions. The first step however in developing a great marketing plan is understanding the customers you are targeting.

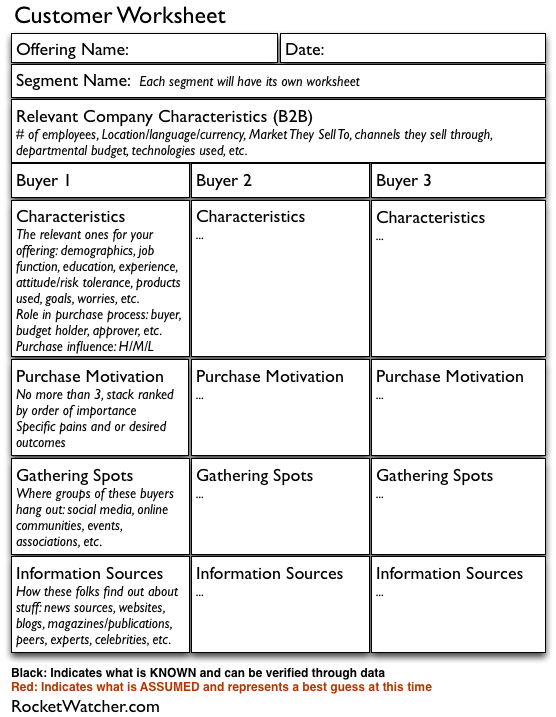

This might seem obvious but in my experience this is often a difficult process. In every startup where I’ve been the head of marketing, getting a crisp definition of our targeted buyers was a process of discovery, testing and revision. I realized that it was very important to capture what we knew and what we assumed about our target buyers so that we could have a working record to guide our marketing efforts. Below is a generic version of the customer worksheet I’ve used for years.

What This Template is Not

This is NOT a buyer persona exercise which some companies do as part of their product management process. I believe in marketing doing a deep dive on personas in some cases, (where you sell to complex buying teams or you have a large marketing team that doesn’t have deep customer knowledge). If you want to learn more about personas I highly recommend you check out Adele Revella’s Buyer Persona Institute where she has a ton of resources available and knows more about that stuff than you, me and everyone we know piled together.

A Worksheet for Startups to Document Assumptions and Focus Their Marketing Efforts

The context here is to think about buyers purely in terms of what you need to understand in order to build a marketing plan in a startup environment. The goal is to outline enough about your segments and buyers to begin to build marketing programs that target them. This worksheet might be filled with more assumptions than facts on the first try but that’s OK. Part of the value of using a tool like this is that the team can get a shared understanding of what is REALLY known and not known about buyers at a given moment in time. You’ll be coming back to this document after you’ve got new marketing program performance data that will help you refine it.

Like everything else on this blog, it’s based on my experiences as a head of marketing at a series of startups. My background is B2B so the template is biased toward that (but that said, I think it works for B2C as well). Here’s the template and some notes on how I use it:

Offering Name and Date – The reason I’ve included a date field is because this is not a static document. This document is an input to the overall marketing plan and is reviewed regularly when you have a new set of marketing statistics to analyze. In particular you are looking for potential shifts that would impact what you have on this sheet (either confirming assumptions or calling into question the accepted facts). Therefore it’s important to know when this document was last reviewed.

Segment Name – I would have a worksheet for every target segment. For example I talked to a startup this week that had an offering related to student loans with 2 distinct segments – Universities, and Banks that handle large numbers of student loans.

Company Characteristics – Obviously this one is for B2B companies only. The key here is to capture in as much detail as possible, who your ideal target companies are. This will include the obvious stuff (geographic region, language, company size) and things that are more specifically related to the solution you are selling such as organization structure, supply chain, technology used, risk tolerance, compliance environment, etc.

Buyer Characteristics – You might have a single buyer or you might have multiple people involved. Here I am using the word “buyer” to represent anyone who has a good deal of influence over a purchase. For example, if you are selling toys for young children you will have to worry about marketing both to kids and parents. Technically parents are the “buyer”, but kids still have a lot of influence over what toys get chosen. Similarly when selling to larger enterprises you might be selling to a single buyer or a decision-making team. Deciding which of these buyers you will need to focus on depends a lot on how influential they are in the purchase process, which is why you will see a spot to capture that on the template. The characteristics you capture here need to be as specific as possible. Job titles alone for example are usually insufficient to describe who you are really going after, you need to get into facets of what your buyers know and have experience with, their tolerance for risk, and sometimes their desires and worries.

Purchase Motivation – Sometimes this is really related to a specific pain that the customer has (project failure rates are high, our order entry process is too slow, our employee retention rate is too low) or it could be more oriented around a desired outcome (I will look smarter, my friends will be impressed, I will get promoted). Sometimes there is a specific purchase trigger (such as a specific product/process failure, a pregnancy or engagement, a new regulation to comply with), if so those need to be captured here as well.

Gathering Spots – Generally if you can describe a group of target buyers in a very specific way, you can identify places where they gather. This could be online in specific communities or on specific social networks, or in person at events, conferences, association meetings, training or certification meetings, etc. This will serve as a starting point when thinking about marketing channels and where to get in front of your target prospects.

Information Sources – This is where your target buyers go and who they look to when they are looking to learn, do research, get inspired or simply find out what’s new. This will include online and offline news sources, experts, celebrities, industry review sites, vendor information sources, their peers and places where their peers share information.

Facts versus Assumptions – The Magic Happens Here

Companies fail for lots of reasons but in my experience most bad marketing happens because of poor assumptions about target buyers. I’ve had times where we were blowing our budget marketing to the wrong person in the organization or trying to reach them in places they just weren’t. I see this a lot today with startups spending a lot of effort building a profile on social networks or working to get coverage in certain publications that their target buyers simply don’t know about (shockingly not everyone reads TechCrunch or uses Pinterest). Color coding the information in this template helps highlight what is known and not really known but assumed. Here are some important points about this:

- Anecdotal information from your sales team (or anyone else, including you) is not data – Your sales team will tell you that they understand your target buyers better than anyone else in the company but without data to back it up, they simply have an opinion – one informed by the last handful of customers they spoke to granted, but simply an opinion. Data comes from campaign results, sales data from a larger number of customers, survey data (but only when the survey was smartly executed in the first place) or when all else fails, data compiled from having conversations with a TON of prospects. If I’m doing it the last way I start feeling comfortable after 20 conversations, I feel like I’m really good after 50.

- Some Assumptions Need Immediate Testing, Others Don’t – Some assumptions, if they turn out to be wrong could be disastrous, others not so much. For example if you have assumed that a particular buyer is the budget holder in an organization and it turns out they often are not, you could waste some serious budget trying to market to them. I would want data on that before I got started. You will have to make a call on which assumptions need to be explicitly tested and which you can simply mark as assumed and look for data that gives you clues about whether you assumed correctly or incorrectly.

I would really love your feedback on this one. Does this work for you? Are you using something similar? Are there obvious holes?

1. so an offering is like an advertising campaign? a specific event, ran as an experiment to forcibly prove your hypothesis false?

2. I know this is only the start of the marketing (get to know your assumed customer), but I want the next course already 🙂 , i want to plan the marketing tactic as an experiment to see if the hypo was false

3. I also kind of assume that this portion should have been done and documented during the founders customer discovery process of the main idea. Are you saying in your experience

a. that step was not done

b. it was done but not well enough

c. it was done, but not communicated to the people who are creating the marketing materials / operations?

d. or do this every time before creating any marketing campaign to make sure your assumptions about the target prospect are still correctly understood be all in the team?

small typo Queenie :), Company Characteristics section, idea should be ideal?

wish i could get to TO to attend your class 🙁

Here’s my answers:

1/ The offering is your product (not the marketing tactic).

2/ Sometimes you will want to test the assumptions specifically, other times you won’t. Sometimes they will be very, very difficult to test (in the case of long sales cycles or where the sales volumes are low).

3/ Ah – this is the crux of this post. I have seen very, very few examples where the customer discover process gave you what you needed at this level of detail. Even if you are complete customer development weirdos you probably didn’t look into the last 2 rows. The other thing that frequently happens is that the startup knows what market they are going to target but not to enough detail to really understand how to target these folks. The number of times I have have startups tell me they are targeting “SMB” tells me this is true. SMB is a massive segment. You cannot model a general SMB buyer, you need to get more specific. The other thing to note is that although everyone seems to have read the lean startup book – I still don’t see a lot of real customer development going on.

The workshop is going to be EPIC. More details on that later 🙂

April

Oh and nice catch on the typo – thanks!

Hi April,

great post. It is really important to use two ink colors for facts and assumptions as you suggest. Every startup’s goal should be to convert at least half of that red ink into black.

I’m by far not someone who would obsess over competition, but I would be interested how you’d address existing competitive products, alternative “workarounds” or customers’ objections when they’re reluctant to change or simply not motivated enough to buy.

I guess this should go into the plan, though it may or may not be part of the customer worksheet. What are your thoughts?

Hi Marko,

Good question. In my experience when it comes to competitive positioning and objection handling is really important to understand the stage the customer is at in the buying cycle. For example – if the customer is simply not motivated to buy is that because they don’t understand that they have the problem, because they don’t understand the value of the solution or because they think they have already solved the problem? Ditto if the customer has a solution today and is reluctant to change – is that because they don’t see additional value in making the switch, because they think they can’t afford to switch, because they think switching is going to be too much of an effort? The place in the marketing plan process where I usually get into this is when I’m working through thinking about friction points and accelerators in the customer buying process. I covered this a little bit in this post: http://www.rocketwatcher.com/blog/2012/07/modelling-the-customer-buying-process.html

Love this April – thanks – we use a similar approach and have really good success in getting people focused on what they do, who they do it for and importantly, where and how they can best tell that story for the most impact.

Thanks Martin!